Service Tax Registration

Service Tax Registration

Service Tax

It is an indirect tax wherein the service provider collects the tax on services from service receiver and pays the same to government of India. Service Tax Application is mandatory for anyone involved in the service industry. Service tax applies only to services sold within India Service tax is an indirect tax levied on a wide array of services specified by the Central Government under the Finance Act, 1994 Service tax applies only to services sold within Service Tax registration is mandatory for every person or business in India that has provided a taxable service of value exceeding Rs.9 lakhs, in the previous financial year Service Tax must be collected when your revenues are Rs. 10 lakh or over. Service Tax is to be paid to government via designated branches once every quarter by LLPs, partnerships and sole proprietors and once every month by all other entities.

Service Tax Rates:

- The form ST-1 should be filled.

- The documents to be given-copy of PAN card, address proof of registration and in case of firm, constitution or partnership deed.

- Once the Service Tax Application and the attached supporting documents are verified, the Tax Department will allot Service Tax Regisration (ST2) for your business

Documents Required For Service Tax Registration

FROM INDIVIDUAL

- 4 pass size photos of proprietor

- Rental agreement and electricity bill of office address

- NOC for registered office

- Bank statement of proprietor

- PAN Card

FROM COMPANY

- Certificate of Incorporation

- MOA/AOA

- PAN Card

- 4 pass size photos director

- Rental agreement and electricity bill of office address

- NOC for registered office

- Bank statement of company

Frequently Asked Questions

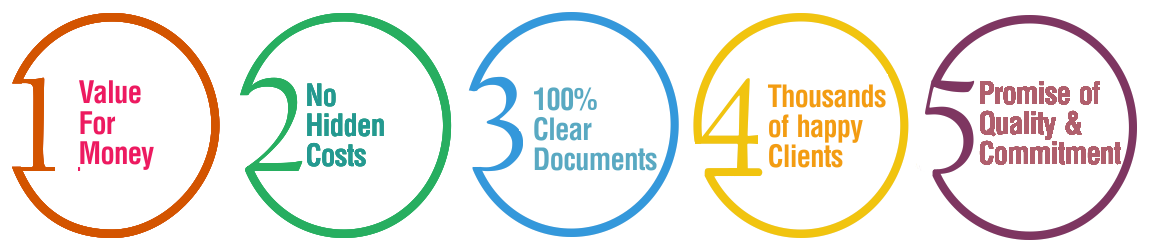

Why Choose BusinessWindo.Com ?