Sole Proprietorship Registration

Within 7 Days

- CA Certificate to open a Current Account

-

GST Certificate / Labour Certificate / MSME

Certificate as per the Requirement of the Client

Sole Proprietorship Registration

Sole Proprietorship Firm

As the name suggests, a sole proprietorship firm is formed by one individual, called the “proprietor” who will be solely responsible for the business and its transactions. A sole proprietorship firm does not enjoy a distinct legal entity unlike a private limited company or a limited liability partnership. The owner or the proprietor and the firm are treated as one unit; that is, the firm and its owner are not different from each other. To open a sole proprietorship firm, the proprietor needs to choose a name for his or her business and a place to carry out the business. There are no legal formalities involved and even registering a sole proprietorship firm is not compulsory.

What is Proprietorship Registration?

A sole proprietorship firm can be brought into existence by just opening a bank account in the name of the firm. There are no legal formalities required to form a sole proprietorship firm. This is because the firm is viewed as an addition to the proprietor. The proprietor needs to have a PAN card, a few required licenses and funds to establish the firm. The proprietor then has to open a current account in the name of the firm and furnish two necessary documents as proofs from a list of documents that are acceptable. The list contains documents such as GST Certificate or Labour Certificate/MSME certificate, PAN and address proof of proprietor, rental agreement and utility bill for office address proof and mandatory CA certificate. The proprietor should submit any two of these documents to open the current account with the bank.

Key Features of Sole Proprietorship Firms

1. The owner of a sole proprietorship firm has unlimited liability and full control over the business and its operations. The proprietor is not legally accountable to anyone for his or her acts and he or she can use the funds, premises of the business as per his or her wish.

2. The proprietor is the sole person responsible for the business; he or she shares the profits or losses incurred by the firm wholly. No other individual or party can claim any share or right to its profits or losses, over the property where the business is carried out, and other assets used for business purposes. In fact, if the proprietor wants, he or she can carry out the business from his or her personal residence too without any problem.

3. The proprietor also has the authority to hire employees and decide how much to pay them for their services. He or she can also decide to let off people based on business requirements. Unlike other forms of companies where business partners are bound by a deed, the proprietor here has all rights to decide how to execute the business.

4. A sole proprietorship firm ceases to exist in the event of death or incapability of the proprietor. Because there are no other partners involved, the situation of transferability of ownership rights does not arise.

5. To file its taxes, a sole proprietorship firm is required to fill a form called Schedule C mentioning its various incomes and expenditures. The proprietor may wish to remove expenses such as transport, office, phone etc while filing for the same.

Advantages of Sole Proprietorship Firms

A sole proprietorship firm is the best option for those who want to start a business on their own and then expand slowly. This is perfect for small businesses or shops, where the investment capital is minimal and the business can be carried out by one person. Most local shops and boutiques are sole proprietorship ones managed and controlled by a single owner.

A sole proprietorship firm can convert itself into other types of business like private limited company, LLP, etc if it wishes so. To do so, the proprietor needs to fulfill the requirements needed for the type of business he or she wants to get converted to. For instance, the proprietor should comply with the documentation process, mandate of minimum members or partners, contribute minimum capital required, if any, to complete the process.

It is quite easy to form a sole proprietorship firm as there are no extensive legal procedures. Anyone with a PAN, Aadhaar and address proof can form a sole proprietorship venture. It can take as little as one to two weeks to open such a business. Hence, it is extremely convenient for small shop owners and merchants to choose this form of business.

- Easy To Start

- Full ownership and control.

- Less capital involved.

- Profits are not to be distributed.

- Ease of formation.

- Complete control over all the aspects of business.

- Strong Interpersonal relationships with clients, customers and employees.

- Low Income Tax.

Minimum Requirements for Registering Sole Proprietorship

The proprietor can get the firm registered through certificates in his or her name. To obtain a license for a sole proprietorship firm, the following are required.

The proprietor needs to have a valid PAN card to register the firm. This PAN will be used to open bank account; file annual tax and get other registrations if required. Aadhaar card is another important document that will be needed to form a sole proprietorship venture. Aadhaar has now become mandatory to register any business in India and the same can be applied through any of the centers of Aadhaar Seva Kendra.

The proprietor can get himself or herself registered under Small and Medium Enterprise or an SME. The MSME Act is dedicated to recognize small scale enterprises in the country. Often, sole proprietorship firms find it easy avail loans or credit if they are registered as an SME. The proprietor can also approach the local authorities, where the establishment is located, to obtain a Shop Act License. It is not compulsory, but advisable, to avoid unnecessary interferences from the unauthorized individuals.

Finally, the firm needs to be GST compliant if the yearly revenue exceeds Rs 20 lakhs and in case of an ecommerce/online establishment. Registering under GST is simple and can be done online on the GST portal. Once the application is done and necessary documents are submitted, the firm can receive a GST number within a week. There are several certified consultants that can guide proprietors on Sole Proprietorship Registration in India in exchange of a minimal advisory fee.

Documents Required Sole Proprietorship

- PAN Card

- Address Proof ( Voter ID, Passport, DL or Aadhar)

- Electricity bill + Rent agreement where you want to run your business.

Sole Proprietorship Registration Process

Here you can refer the steps to register a Sole Proprietorship in India

There are two main steps that proprietors need to know on how to incorporate a Proprietorship Firm in Bangalore, Karnataka and other major cities. First is, licensing the firm under local or Central Government license registration. Second is registration for GST. Types of Local or Central Government licenses include MSME registration, authentication by Chartered Accountants (CAs), Shop Act License and income tax returns of the business.

The proprietor can choose to opt for any two of these to get the business registered. The proprietor can opt for MSME registration if he or she wants the business to avail the benefits or subsidies that are given to small and medium enterprises by the Govt. Certified CAs can authorize the ingenuity of the business documents and authenticate those to go ahead with the registration. Proprietors can get in touch with registered CAs to help them with Proprietorship Firm Registration in Bangalore and other cities in India. The proprietor can approach the municipal authorities to issue a license for the shop in the area where it is located. Besides these, some banks might also need ITR-4 showing the tax returns of the business.

Sole proprietorship firms are also required to be GST registered where the revenues are expected to cross Rs 20 lakhs for transactions within the state. If the firm executes transactions outside the state, it will need to quote the GST number even if the revenues are below Rs 20 lakh. Further, if the proprietor is doing business online or has an ecommerce shop set up, GST is needed.

To register the firm, the proprietor has to ensure that all required documents are in place. Then the proprietor has to apply for any two of MSME certification, CA authentication, Shop Act license or ITR-4 and GST registration. Once the proprietor receives the certificate from the authorities, a current account can be opened in the bank in the name of the business and sole proprietorship firm will be regarded as a registered business. Proprietors can consult advisory firms to register a Sole Proprietorship in Bangalore and other parts of India.

What You will Get After Proprietorship Registration?

- CA Certificate to Open a Current Account

- GST Certificate or Labour Certificate or MSME Certificate as per the Requirement of the Client.

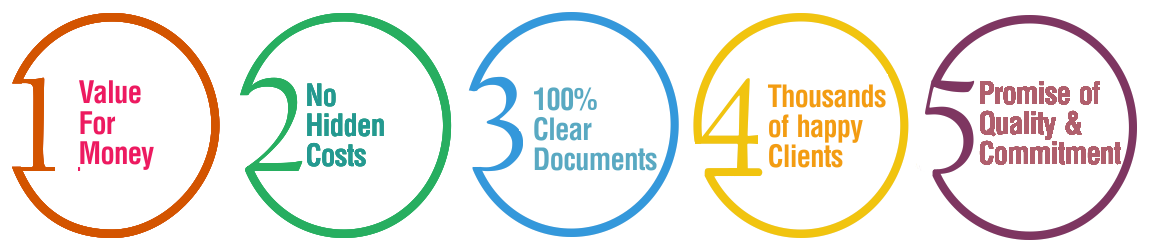

Why Choose BusinessWindo.Com ?