Addition of Designated Partner

- Applying DSC & DIN

- Change of LLP Agreement

- Drafting Consent Letter for Existing Partner and New Partner

- Filing Necessary e-forms to Concerned ROC

Addition of Designated Partner

Addition of Designated Partner

The Limited Liability Partnership is much long awaited form business type. Many of the countries in the world adopted this type of business. Now it comes true in India. Limited Liability Partnership Act, 2008 ('Act' for short) was enacted with the objectives to make provisions for the formation and regulation of limited liability partnerships and for the matters connected therewith or incidental thereto. The LLP is a body corporate formed and incorporated under the Act and is a legal entity separate from that of the partners. Most of the provisions of the Act resemble with the provisions of the Companies Act. The management of the company is run by the Board of Directors. In LLP there is no such directors and but in their place the partners called as 'Designated Partners' are placed.

THINGS TO KNOW

- An individual shall not become a designated partner in any LLP unless he has given his prior consent to act as such to the LLP in Form

- An individual eligible to be a designated partner shall satisfy such conditions and requirements as may be prescribed; Rule 9(1) of Limited Liability Partnership Rules, 2009 provides that a person shall not be capable of being appointed as a designated partner of a LLP, if he-

- Has at any time within the preceding five years been adjudged insolvent; or

- Suspends, or has at any time within the preceding five years suspended payment to his creditors and has not at any time within the preceding five years made, a composition with them; or

- Has been convicted by a Court for any offence involving moral turpitude and sentenced in respect thereof to imprisonment for not less than six months; or

- dHas been convicted by a Court for an offence involving section 30 of the Act.

- Every designated partner of a LLP shall obtain a Designated Partner's Identification Number ('DPIN' for short) from the Central Government and the provisions of Sections 266A to 266G (both inclusive) of the Companies Act shall apply mutatis mutandis for the said purposes

Documents Required

- PAN Card

- Voter Id / Aadhaar Card

- Driving License / Passport

- Latest Bank Statement / Mobile Bill

- Passport Size Photograph

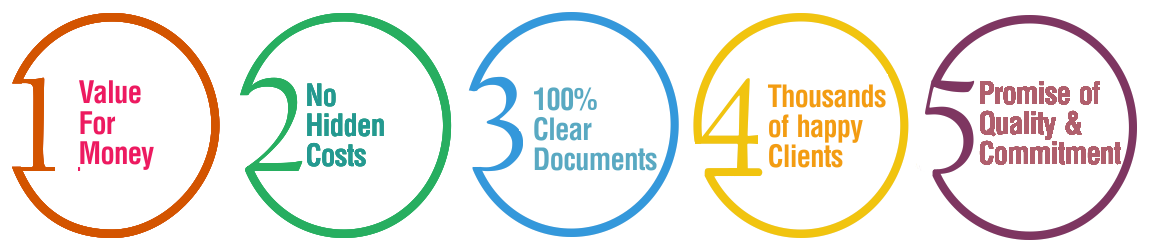

Why Choose BusinessWindo.Com ?