Professional Tax Registration

Get your Professional Tax registration in 15 days

Professional Tax Registration

Professional Tax Registration

A professional tax is tax levied by the State on the Income earned by way of profession, trade, employment. This form of tax was first levied in India in the year 1949 and the power to levy professional tax has been given to States by way of Clause (2) of Article 276 of Constitution of India. A Professional tax in India is collected by some states themselves while in several other states which have active Panchayats, local bodies themselves levy this tax. Every person is liable to pay this Tax shall apply for professional tax registration in the prescribed form with prescribed authority.

Any amount paid as Professional Tax to the State Government is allowed as deduction under Section 16 of the Income tax Act, 1961 and Income tax on the Balance amount us levied as per the Income Tax Slab rates in force. In case of Salaried and Wage earners, professional tax is liable to be deducted by the Employer from the Salary/Wages and the employer is liable to deposit the same with the state government. In case of other individuals, this tax is liable to be paid by the person himself.

Professional tax in Karnataka is levied under the “Karnataka Tax on Professions, Trade, Callings and Employment Act, 1976. Professional Tax in Karnataka is applicable if employee monthly salary/wage is above 15000 per month, then the taxable amount is 200 per month subject maximum amount payable is 2500.

Documents Required For Professional Tax Registration

- MOA/AOA

- ORENTAL AGREEMENT/TITLE DEED

- ELECTRCITY BILL

- PAN COPY OF THE COMPANY

- BOARD RESOLUTION

- BANK ACCOUNT DETAILS AND STATEMENT

- PHTOTOGRAPHS OF DIRECTORS

- ADDRESS PROOFS & ID PROOF OF DIRECTORS

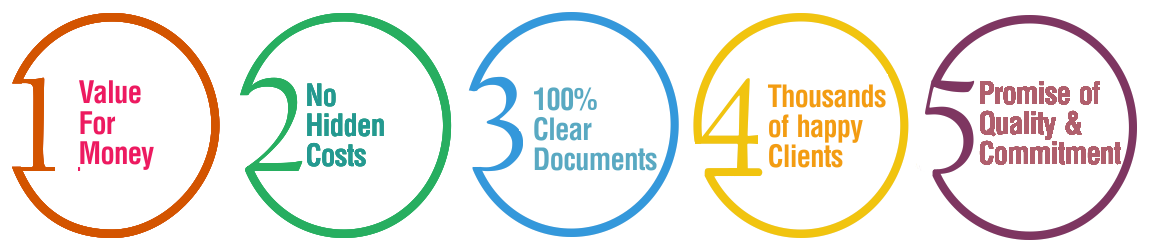

Why Choose BusinessWindo.Com ?