NBFC Registration in India

- DSC for Directors

- DIN for Directors

- Memorandum Of Association (MOA)

- Articles Of Association (AOA)

- Company Incorporation Certificate

- Company PAN & TAN

- Share issuance for upto 50 shareholders

NBFC Registration in India

NON BANKING FINANCIAL COMPANY

NBFC is a company registered under the Companies Act, 2013 engaged in the business of loans and advances, acquisition of shares/stocks/bonds/debentures/securities issued by Government or local authority or other marketable securities of a like nature, leasing, hire-purchase, insurance business, chit business but does not include any institution whose principal business is that of agriculture activity, industrial activity, purchase or sale of any goods (other than securities) or providing any services and sale/purchase/construction of immovable property. A non-banking institution which is a company and has principal business of receiving deposits under any scheme or arrangement in one lump sum or in instalments by way of contributions or in any other manner, is also a non-banking financial company (Residuary non-banking company)

NBFC’s are those which don’t posses banking license, like the commercial or co-operative banks, but offer a variety of supportive and helpful services to public depositors, borrowers and investors in some selected areas of business. NBFC’s act as bridge between the banking and financial sector of the country. The usual and the most favoured business areas of these NFC’s are leasing and finance, commercial and industrial loans, hire purchasing , investment funds, instruments of the capital and money market, chit business and other similar activities.

The main features of the NBFC are as follows:

- The NBFCs are allowed to accept/renew public deposits for a minimum period of 12 months and maximum period of 60 months. They cannot accept deposits repayable on demand.

- NBFCs cannot offer interest rates higher than the ceiling rate prescribed by RBI from time to time. The present ceiling is 12.5 per cent per annum. The interest may be paid or compounded at rests not shorter than monthly rests.

- NBFCs cannot offer gifts/incentives or any other additional benefit to the depositors.

- NBFCs should have minimum investment grade credit rating.

- The deposits with NBFCs are not insured.

- The repayment of deposits by NBFCs is not guaranteed by RBI.

- Certain mandatory disclosures are to be made about the company in the Application Form issued by the company soliciting deposits.

The NBFC registration is applicable for registered bodies such as Private Limited, Public Limited and Limited Liability Partnership subject to the conditions prescribed RBI. After which the above bodies could apply for the license to RBI. The main criterion is to have net owned fund of 200 lakhs. The documents required for applying license to RBI.

Documents Required

- Certified copies of Certificate of Incorporation and Certificate of Commencement of Business in case of public limited companies

- Certified copies of extract of only the main object clause in the MOA relating to the financial business.

- Board resolution stating that:

- The company is not carrying on any NBFC activity/stopped NBFC activity and will not carry on/commence the same before getting registration from RBI

- The UIBs in the group where the director holds substantial interest or otherwise has not accepted any public deposit in the past /does not hold any public deposit as on the date and will not accept the same in future

- The company has formulated “Fair Practices Code” as per RBI Guidelines

- The company has not accepted public funds in the past/does not hold any public fund as on the date and will not accept the same in the future without the approval of Reserve Bank of India

- The company does not have any customer interface as on date and will not have any customer interface in the future without the approval of Reserve Bank of India

- Copy of Fixed Deposit receipt & bankers certificate of no lien indicating balances in support of NOF

- For companies already in existence, the Audited balance sheet and Profit & Loss account along with directors & auditor’s report or for the entire period the company is in existence, or for last three years , whichever is less, should be submitted

- Banker’s report in respect of applicant company, its group/subsidiary/associate/holding company/related parties, directors of the applicant company having substantial interest in other companies The Banker’s report should be about the dealings of these entities with these bankers as a depositing entity or a borrowing entity.

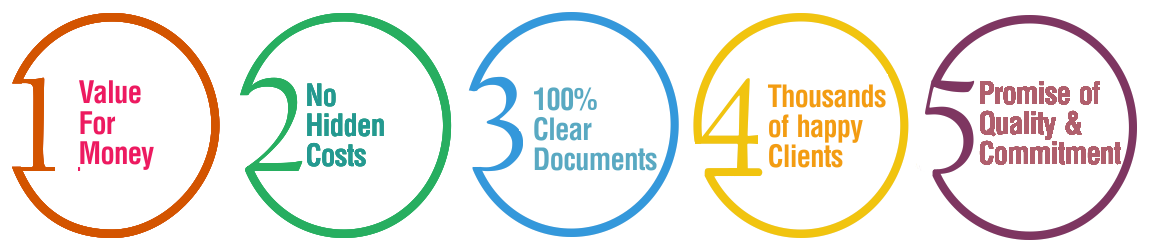

Why Choose BusinessWindo.Com ?