Income Tax Returns

Within 7 Days

Income Tax Returns

Who has to file it ?

Every individual earning more that Rs 2.5 lakhs per annum has to file income tax return. Every company, LLP, Partnership Firm irrespective of its income has to file income tax return.

Why file income tax return ?

Correct and timely Income tax return is to be filed so as to avoid harassment by tax authorities and to avoid heavy penalties. Also a strong income tax helps to increase your credibility with banks and investors.

How can I file a Income tax return?

1. All you have to do is fill a simple form on the website and give us some essential information like details of your Form 16, investment details, company balance sheet, the state you carry out your operations etc.

2. Our expert team will help optimize your tax.

3. Thereon, file your income tax return. Upon successful completion of the process, we will mail you the Verification acknowledgment form to your registered email address.

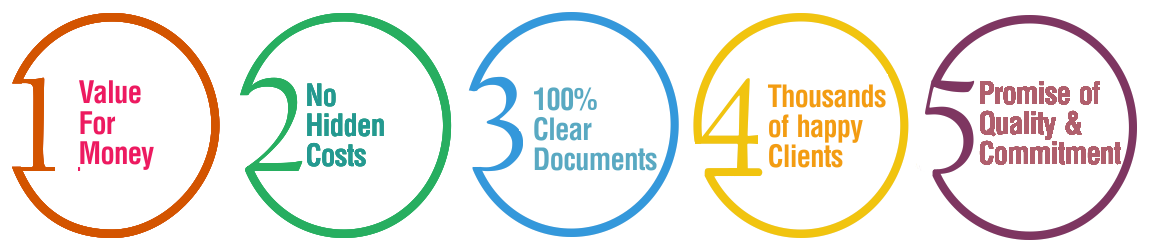

Why Choose BusinessWindo.Com ?