Goods and Services Tax

- Digital Signature Certificate (DSC)

- GST Certificate

- Auditor Certificate for Proprietorship to Open a Current Account

- GST Invoice Format

Goods and Services Tax

Goods and Services Tax

Goods and Service Tax (GST) is the tax levied by the central government and state government together to subsume most of the taxes like Excise Duty, VAT, Service tax, Entry tax and even the customs duty. Hence, it is very important to understand the registration procedure under GST because even the existing dealer will also have to apply for the GST registration online.

GST is the biggest tax reform in the country since Independence. GST would bring about a radical change from the existing tax regime and it would change the way of businesses are carried out today. GST will have an impact across business functions such as finance, IT, supply chain, accounting etc.

What is Goods and Services Tax (GST)?

GST is a comprehensive destination based consumption tax levied on the supply of all goods and services. It is proposed to be levied at all stages right from manufacture up to final consumption with credit of taxes paid at previous stages available as setoff.

Any person making taxable supplies of goods and services would be required to charge Central GST (CGST) & State GST (SGST) on intra State supplies and Integrated GST (IGST) on inter State supplies.

What is the meaning of ‘Goods’ under GST?

Goods have been defined to mean every kind of movable property other than money and securities but specifically include actionable claim.

What is the meaning of ‘Services’ under GST?

Services have been defined to mean anything other than goods, money and securities. The definition also specifically includes activities relating to the use of money or its conversion by cash or by any other mode, from one form of currency or denomination to another form of currency or denomination for which a separate consideration is charged.

GST Registration:

Who all are liable to register under GST?

This is one of the most important questions, as once GST is implemented everybody will be asking this question, whether I am covered under GST or not?

Every person is required to obtain registration in the State(s) from where he makes a taxable supply of goods or services or both, if his aggregate turnover in a financial year exceeds INR 20 lakhs.

However, the threshold is INR 10 lakhs for special category states (i.e. Arunachal Pradesh, Assam, Manipur, Meghalaya, Mizoram, Nagaland, Sikkim, Tripura, Himachal Pradesh, Uttarakhand).

Who are all required to obtain GST registration even though your aggregate turnover in less than INR 20 Lakhs?

In case you are engaged in any of the operations / transactions outlined below, you shall be required to be registered compulsorily irrespective of the threshold limit:

- Making any inter-State taxable supply;

- Required to pay tax under reverse charge mechanism;

- Required to deduct tax;

- Making taxable supply of goods or services or both on behalf of another taxable persons whether as an agent or otherwise;

- Input Service Distribution;

- Supplying goods or services or both through electronic commerce operator

- Shere you are an Electronic commerce operator;

- Supplying online information and data base access or retrieval services from a place outside India to a person in India, other than a registered person.

How to File GST Application Online:

An Applicant opting for registration under GST required to file GST Application along with business proof and other documents.

GST Registration Procedure:

Step-1: If On above time you are not able to register don’t be panic you can go for direct registration from 25/06/2017. On the occasion of GST rollout from 1st July 2017 by submitting From GST REG -1 online along with documents needs to be upload.

Step-2: After uploading of all the documents along with GST REG-1, system will generate Acknowledgment along with ARN in Form GST REG-2.

Step-3: If any additional Information required that information can be asked by department by sending Notice in Form GST REG -3.

Step-4: After receiving notice in GST REG-3, the applicant needs to upload supporting documents in Form GST REG -4 within the Date mentioned in Notice in form GST REG-3

Step-5: After receipt of GST REG -4 the information found to not satisfactory the concerned officer may reject the application by mentioning the reasons for rejection in from GST REG-5.

Step-6: If the Form GST REG-1 or Form GST REG-4 as the case may be found to be satisfactory then the applicant will receive the Registration certificate in Form GST REG -6.

Document Required for GST Registration:

- Photographs (wherever specified in the Application Form)

- Constitution of Business (supporting documents).

- Proof of Principal Place of Business.

- Bank Account Related Proof.

- Authorization Form.

Which of the existing taxes are proposed to be subsumed under GST?

GST would replace several taxes levied by the Centre as well as States. These include –

I) Taxes currently levied and collected by the Centre:

- Central Excise duty

- Duties of Excise (Medicinal and Toilet Preparations)

- Additional Duties of Excise (Goods of Special Importance)

- Additional Duties of Excise (Textiles and Textile Products)

- Additional Duties of Customs (commonly known as CVD)

- Special Additional Duty of Customs (SAD)

- Service Tax

- Central Surcharges and Cesses, so far as they relate to supply of goods and services

II) State taxes that would be subsumed under the GST are:

- Value Added Tax (VAT)

- Central Sales Tax (CST)

- Luxury Tax

- Entry Tax

- Entertainment and Amusement Tax (except when levied by the local bodies)

- Taxes on advertisements

- Purchase Tax

- Taxes on lotteries, betting and gambling

- State Surcharges and Cesses, so far as they relate to supply of goods and services

Who all are liable to enroll GST?

Existing taxpayers are liable to enroll under GST system portal. An existing taxpayer is an entity registered with any of the authorities;

- Central Excise

- Service Tax

- State sales tax/VAT (except exclusive liquor dealers)

- Entry tax

- Luxury Tax

- Entertainment tax

If you wish to avail GST Registration Service for your business please fill the Form or contact us.

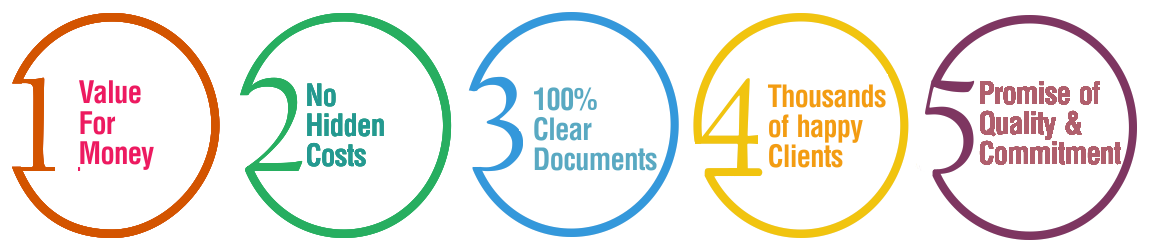

Why Choose BusinessWindo.Com ?