SECTION 8 NON-PROFIT ORGANISATION Registration

Within 30 Days

- DSC for Directors

- DIN for Directors

- Memorandum Of Association (MOA)

- Articles Of Association (AOA)

- Company Incorporation Certificate

- Company PAN & TAN

- SECTION 8 LICENSE

SECTION 8 NON-PROFIT ORGANISATION Registration

SECTION 8 NON-PROFIT ORGANISATION

The concept of non-profit making company is quite old in India. In erstwhile Companies Act, 1956 it was regulated by Section 25 and that is why it was popular as Section 25 Company. However in Companies Act 2013 provisions related to non-profit making company are given in Section 8 read with Rule 19 and 20 of Companies (Incorporation) Rules, 2014. Under Indian law, 3 legal forms exist for NGO or Non-Profit Organizations Trusts, Societies, Section 8 Companies. Due to better laws, Section 8 Companies have the most reliable strongest organizational structure Indian Trusts have no central law, Indian Societies have different legal and institutional frameworks from state to state. Indian Companies including Section 8, have one uniform law across the country Companies Act, 2013. It is this robust Act that regulates the formation, management and accountability of a Section 8 company, thus making it more closely regulated and monitored than trusts and societies, and recognized all over the world.

Section 8 Company or a Non-Profit organization (NPO) is a Company established for promoting commerce, art, science, religion, charity or any other useful object, provided the profits, if any, or other income is applied for promoting only the objects of the company and no dividend is paid to its members.

THINGS TO KNOW

- These companies incorporated only for promotion of commerce, art, science, sports, education, research, social welfare, religion, charity, protection of environment or any such other object.

- Non- Small Company: As per Section 2 (85) Proviso (B) – Section-8 Company will not treated as Small Company.

- It is duty of Company to prove to Central Government that it will incorporate for above mentioned purpose only.

- Firm as a member of Non-Profit making Company: As per section 8(3) a partnership firm may become a member of the non-profit making company registered under section 8. Membership of such firm shall cease upon dissolution of the firm.

- Key Benifits :

- Many privileges and exemptions under Company Law.

- Exemption of Stamp duty for registration.

- Registered partnership firm can be a member in its own capacity.

- Tax deductions to the donors of the Company u/s. 80G of the Income Tax Act.

- Without Share Capital: These companies can be formed with or without share capital, in case they are formed without capital, the necessary funds for carrying the business are brought in form of donations , subscriptions from members and general public.

- Not Required To Add The Suffix: Section 8 Companies are not required to add the suffix Limited or Private Limited at the end of their name.. This helps the company to enjoy limited liability without disclosing to the public the nature of liability of its members

- Easy Transferable Ownership: The shares and other interest of any member in the Company shall be a movable property and can be transferable in the manner provided by the Articles, which is otherwise not easily possible in other business forms. Therefore, it is easier to become or leave the membership of the Company or otherwise it is easier to transfer the ownership.

Documents Required For Company Registration

BY DIRECTORS & SHAREHOLDERS

- PAN Card

- Voter Id / Aadhaar Card

- Driving License / Passport

- Latest Bank Statement / Mobile Bill

- Passport Size Photograph

FOR OFFICE ADDRESS PROOF

- Rental Agreement (In English)

- No Objection Certificate

- Electricity Bill

- Sale Deed / Property Deed

- Tax Paid Receipt ( In case of own property )

What you will get ?

- DSC for Directors

- DIN for Directors

- Memorandum Of Association (MOA)

- Articles Of Association (AOA)

- Company Incorporation Certificate

- Company PAN & TAN

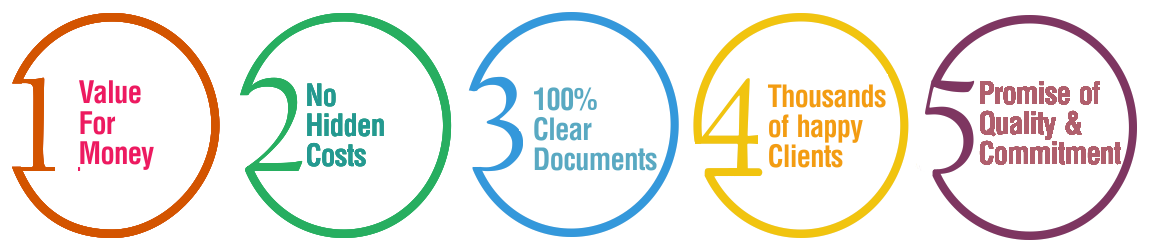

Why Choose BusinessWindo.Com ?