Import Export Code Registration

Get your Import Export Code Registration registration in 15 days

Import Export Code Registration

Import Export Code

The first requirement before you start an import/ export business in India is to obtain an Import Export Code Registration All businesses which are engaged in Import and Export of goods require Import Export Code Registration. IEC Code is 10 digit code with permanent validity. IEC Code is issued by the Directorate General of Foreign Trade (DGFT), Ministry of Commerce and Industries, Government of India. Importers are not allowed to proceed without this code and exporters can’t take benefit of exports from DGFT, customs, Export Promotion Council etc if they don’t have this code

Features of Import Export Code

- All importers who import goods are required to obtain Import export code registration and all exporters need this code to obtain the benefits of exports.

- IEC code does not require filling of any returns.

- IEC Code is issued for the lifetime and requires no renewal.

- Even individuals who are proprietors can obtain the code on there names.It is not necessary to setup a Business.

Documents Required For Import Export Code

- RENTAL AGREEMENT/TITLE DEED

- ELECTRCITY BILL

- PAN COPY OF THE COMPANY

- BOARD RESOLUTION

- BANK ACCOUNT DETAILS AND STATEMENT

- PHTOTOGRAPHS OF DIRECTORS

- ADDRESS PROOFS & ID PROOF OF DIRECTORS

- MOA/AOA

Frequently Asked Questions

IEC Stands for IMPORTER EXPORTER CODE

Any bonafide person / company starting a venture for International trade

No. IEC forms a primary document for recognition by Govt. of India as an Exporter / Importer.

On the basis of IEC, companies can obtain various benefits on their exports / imports from DGFT, Customs, Export Promotion Council etc.

IEC can be obtained from the nearest Zonal DGFT depending on where the company is located. eg Mumbai firm can get it from Mumbai DGFT

Application fee can be paid through EFT electronic fund transfer from the designated bank, TR6 Challan paid at CBS branches of Central bank, Demand Draft / Pay Order from any designated bank in favour of Zonal Jt. DGFT.

Rs.200/- payable in form of TR6 Challan, Pay order

Yes, PAN is mandatory. Photocopy of PAN card has to be submitted along with the application.

Only one IEC would be issued against a single PAN number. Any proprietor can have only one IEC number and in case there are more than one IECs allotted to a proprietor, the same may be surrendered to the Regional Office for cancellation

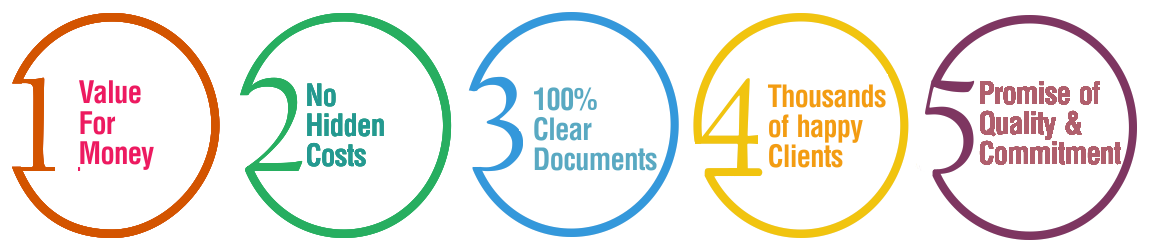

Why Choose BusinessWindo.Com ?