One Person Company Registration

Within 7 Days

- DSC for Directors

- DIN for Directors

- Memorandum Of Association (MOA)

- Articles Of Association (AOA)

- Company Incorporation Certificate

- Company PAN & TAN

REGISTER COMPANY NOW

One Person Company

A OPC is a type of Private Limited Company where minimum and maximum number of members is one. The One Person Company (OPC) was recently introduced as a strong improvement over the sole proprietorship OPC has limited liability of its members unlike in a partnership firm. It gives a single promoter full control over the company while limiting his/her liability to contributions to the business. This person will be the only director and shareholder (there is a nominee director, but with no power until the original director is incapable of entering into contract). The OPC is one of the most credible structure and preferred over a Proprietorship.

Advantages Of One Person Company

Separate Legal Entity

A company is a legal entity and a juristic person established under the Act. Therefore a company form of organization has wide legal capacity and can own property and also incur debts. The members (Shareholders/Directors) of a company have no liability to the creditors of a company for such debts.

Borrowing Capacity

A company enjoys better avenues for borrowing of funds. It can issue debentures, secured as well as unsecured and can also accept deposits from the public, etc. Even banking and financial institutions prefer to render large financial assistance to a company rather than partnership firms or proprietary concerns.

Limited Liability

Limited Liability means the status of being legally responsible only to a limited amount for debts of a company. Unlike proprietorships and partnerships, in a limited liability company the liability of the members in respect of the company’s debts is limited.

Owning Property

A company being a juristic person, can acquire, own, enjoy and alienate, property in its own name. No shareholder can make any claim upon the property of the company so long as the company is a going concern.

Easy Transferability

Shares of a company limited by shares are transferable by a shareholder to any other person. Filing and signing a share transfer form and handing over the buyer of the shares along with share certificate can easily transfer shares.

Dual Relationship

In the company form of organization it is possible for a company to make a valid and effective contract with any of tis members. Thus, a person can at the same time be a shareholder, creditor, director and also an employee of the company.

Documents Required For Company Registration

BY DIRECTORS & SHAREHOLDERS

- PAN Card

- Voter Id / Aadhaar Card

- Driving License / Passport

- Latest Bank Statement / Mobile Bill

- Passport Size Photograph

FOR OFFICE ADDRESS PROOF

- Rental Agreement (In English)

- No Objection Certificate

- Electricity Bill

- Sale Deed / Property Deed

- Tax Paid Receipt ( In case of own property )

Procedure To Register A OPC Company

Obtaining DSC

( 2 Working Days )

Digital Signature Certificate ( DSC is required for e-filling with MCA. A DSC application need to be filed along with ID and address proof duly attested by bank manager, gadzeted officer or post master. )

Obtaining DIN

( 3 Working Days )

Its a unique number which is alloted to the Director of a company by the Ministry of Corporate Affairs (MCA).

Name Approval

( 1 Working Day )

A minimum of one and maximum of six proposed name can be submitted to the MCA for name approval. Name approval will be obtained within 1 working days.

MOA & AOA

( 1 Working Day )

MOA and AOA are drafted in line with the provision of Companies Act 2013. MOA is a legal documentation which defines activity of the company. AOA is the rule book of company operations.

Company Incorporation

( 2 Working Days )

After submitting the documentation the Ministry of Corporate Affairs will issue a certificate of incorporation.

Applying PAN & TAN

( 3 Working Days )

Once the Ministry of Corporate Affairs issue the company incorporation certificate, we will apply for the TAN & PAN.

What you will get ?

- DSC for Directors

- DIN for Directors

- Memorandum Of Association (MOA)

- Articles Of Association (AOA)

- Company Incorporation Certificate

- Company PAN & TAN

Frequently Asked Questions

One Person Company is set to organize the unorganized sector of proprietorship firms. OPC will have incredible prospect and it will be embraced as a booming business model. For small to mid level entrepreneurs, OPC is the scope for them to grow and to get recognition globally even for their single person entity. Comparatively in OPC there will be less paper work. OPC allows a single person to run a company with limited liability, in case of a sole proprietorship.

One Person Company can be started with any amount of capital. There is no requirement to show proof of capital invested during the incorporation process.

In case the paid up share capital of an OPC exceeds fifty lakh rupees or its average annual turnover exceeds during the relevant period exceeds two crore rupees, then the OPC has to mandatorily convert into private or public company.

Only a natural person, who is an Indian citizen and resident in India shall be eligible to incorporate a One Person Company. Explanation: The term "Resident in India" means a person who has stayed in India for a period of not less than 182 days during the immediately preceding one calendar year.

A person can be member in only one OPC.

The Director of the OPC can be remunerated and contracts can be entered with it shareholders and its directors. Directors’ remuneration, rent and interest are deductible expenses which reduces the profitability of the Company and ultimately brings down taxable income of your business.

Compare Company Registration Options

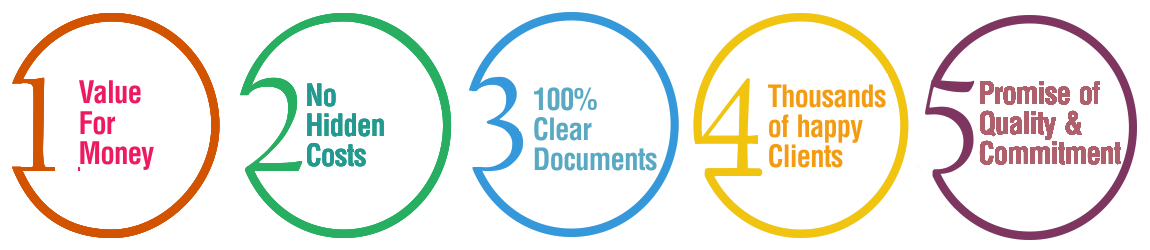

Why Choose BusinessWindo.Com ?